What Is The Property Tax Rate In Moncton Nb . the tax rate is proposed to drop by 1.5 cents, from $1.4443 in 2023 to $1.4287 per $100 of assessed property value, for most of the city. in addition, moncton lowered its tax rate by 6.2 per cent last year. Province scored record $777 million surplus last year. these pages focus on nb property taxes. in new brunswick, rates vary between by local service districts (lsds) and municipalities as well as by property type. A home valued at $330,000 would. provincial property tax rates for the various categories of property are legislated under the real property tax act. the budget would cut the residential rate by 10.3 cents to $1.4443 per $100 of assessed value. For more information about nb property assessment, please visit:

from www.fox21online.com

in addition, moncton lowered its tax rate by 6.2 per cent last year. provincial property tax rates for the various categories of property are legislated under the real property tax act. these pages focus on nb property taxes. For more information about nb property assessment, please visit: the budget would cut the residential rate by 10.3 cents to $1.4443 per $100 of assessed value. in new brunswick, rates vary between by local service districts (lsds) and municipalities as well as by property type. Province scored record $777 million surplus last year. the tax rate is proposed to drop by 1.5 cents, from $1.4443 in 2023 to $1.4287 per $100 of assessed property value, for most of the city. A home valued at $330,000 would.

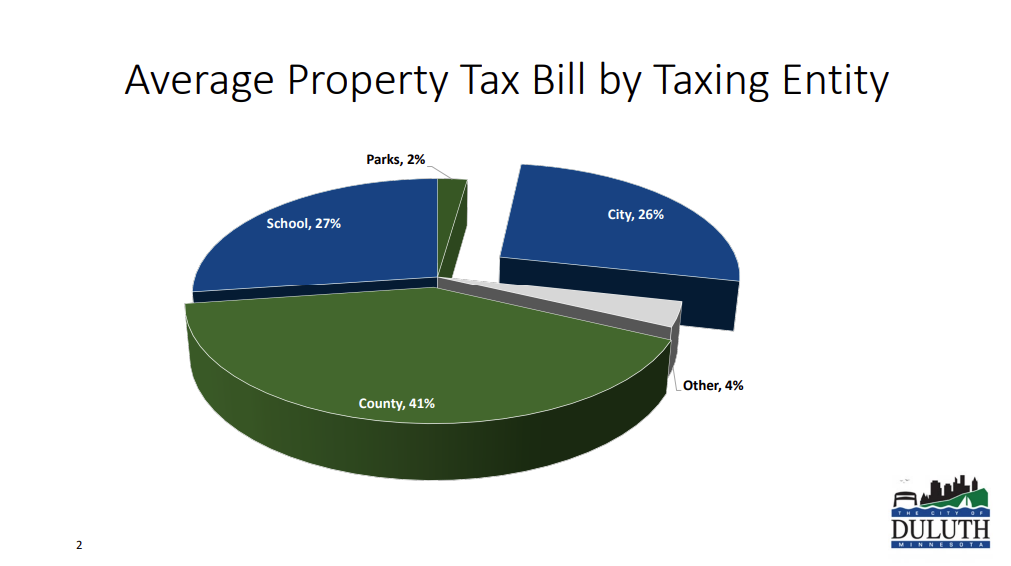

Duluth's Council Approves 8.9 Increase In Property Tax Levy

What Is The Property Tax Rate In Moncton Nb these pages focus on nb property taxes. For more information about nb property assessment, please visit: in addition, moncton lowered its tax rate by 6.2 per cent last year. these pages focus on nb property taxes. in new brunswick, rates vary between by local service districts (lsds) and municipalities as well as by property type. the tax rate is proposed to drop by 1.5 cents, from $1.4443 in 2023 to $1.4287 per $100 of assessed property value, for most of the city. the budget would cut the residential rate by 10.3 cents to $1.4443 per $100 of assessed value. Province scored record $777 million surplus last year. A home valued at $330,000 would. provincial property tax rates for the various categories of property are legislated under the real property tax act.

From www.newsncr.com

These States Have the Highest Property Tax Rates What Is The Property Tax Rate In Moncton Nb A home valued at $330,000 would. these pages focus on nb property taxes. the budget would cut the residential rate by 10.3 cents to $1.4443 per $100 of assessed value. in new brunswick, rates vary between by local service districts (lsds) and municipalities as well as by property type. in addition, moncton lowered its tax rate. What Is The Property Tax Rate In Moncton Nb.

From www.reddit.com

Toronto Is Planning To Increase Property Tax Rates By 10.5 r/TorontoRealEstate What Is The Property Tax Rate In Moncton Nb in addition, moncton lowered its tax rate by 6.2 per cent last year. provincial property tax rates for the various categories of property are legislated under the real property tax act. the budget would cut the residential rate by 10.3 cents to $1.4443 per $100 of assessed value. Province scored record $777 million surplus last year. For. What Is The Property Tax Rate In Moncton Nb.

From www.propertyplateau.com

What is Property Tax? Property Plateau What Is The Property Tax Rate In Moncton Nb the tax rate is proposed to drop by 1.5 cents, from $1.4443 in 2023 to $1.4287 per $100 of assessed property value, for most of the city. Province scored record $777 million surplus last year. in addition, moncton lowered its tax rate by 6.2 per cent last year. A home valued at $330,000 would. For more information about. What Is The Property Tax Rate In Moncton Nb.

From finance.georgetown.org

Property Taxes Finance Department What Is The Property Tax Rate In Moncton Nb A home valued at $330,000 would. the budget would cut the residential rate by 10.3 cents to $1.4443 per $100 of assessed value. For more information about nb property assessment, please visit: in addition, moncton lowered its tax rate by 6.2 per cent last year. the tax rate is proposed to drop by 1.5 cents, from $1.4443. What Is The Property Tax Rate In Moncton Nb.

From dollarsandsense.sg

Annual Value (AV) Of Your Residential Property Here’s How Its Calculated And Why It Matters What Is The Property Tax Rate In Moncton Nb the budget would cut the residential rate by 10.3 cents to $1.4443 per $100 of assessed value. in new brunswick, rates vary between by local service districts (lsds) and municipalities as well as by property type. the tax rate is proposed to drop by 1.5 cents, from $1.4443 in 2023 to $1.4287 per $100 of assessed property. What Is The Property Tax Rate In Moncton Nb.

From www.primecorporateservices.com

Comparing Property Tax Rates State By State Prime Corporate Services What Is The Property Tax Rate In Moncton Nb A home valued at $330,000 would. the tax rate is proposed to drop by 1.5 cents, from $1.4443 in 2023 to $1.4287 per $100 of assessed property value, for most of the city. Province scored record $777 million surplus last year. provincial property tax rates for the various categories of property are legislated under the real property tax. What Is The Property Tax Rate In Moncton Nb.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills What Is The Property Tax Rate In Moncton Nb Province scored record $777 million surplus last year. For more information about nb property assessment, please visit: the tax rate is proposed to drop by 1.5 cents, from $1.4443 in 2023 to $1.4287 per $100 of assessed property value, for most of the city. provincial property tax rates for the various categories of property are legislated under the. What Is The Property Tax Rate In Moncton Nb.

From taxsaleshub.ca

Tax Sale in Albert Westmorland, New Brunswick corner of cumberland/reginald, city of moncton What Is The Property Tax Rate In Moncton Nb in new brunswick, rates vary between by local service districts (lsds) and municipalities as well as by property type. A home valued at $330,000 would. For more information about nb property assessment, please visit: the tax rate is proposed to drop by 1.5 cents, from $1.4443 in 2023 to $1.4287 per $100 of assessed property value, for most. What Is The Property Tax Rate In Moncton Nb.

From itrfoundation.org

Property Tax Rate Limits ITR Foundation What Is The Property Tax Rate In Moncton Nb the tax rate is proposed to drop by 1.5 cents, from $1.4443 in 2023 to $1.4287 per $100 of assessed property value, for most of the city. these pages focus on nb property taxes. A home valued at $330,000 would. provincial property tax rates for the various categories of property are legislated under the real property tax. What Is The Property Tax Rate In Moncton Nb.

From damitaqarleyne.pages.dev

Property Tax Rates By State 2024 Codie Devonne What Is The Property Tax Rate In Moncton Nb provincial property tax rates for the various categories of property are legislated under the real property tax act. the tax rate is proposed to drop by 1.5 cents, from $1.4443 in 2023 to $1.4287 per $100 of assessed property value, for most of the city. in new brunswick, rates vary between by local service districts (lsds) and. What Is The Property Tax Rate In Moncton Nb.

From cpta.org

2023 Location Canadian Property Tax Association What Is The Property Tax Rate In Moncton Nb the budget would cut the residential rate by 10.3 cents to $1.4443 per $100 of assessed value. A home valued at $330,000 would. Province scored record $777 million surplus last year. these pages focus on nb property taxes. the tax rate is proposed to drop by 1.5 cents, from $1.4443 in 2023 to $1.4287 per $100 of. What Is The Property Tax Rate In Moncton Nb.

From taxfoundation.org

Ranking Property Taxes by State Property Tax Ranking Tax Foundation What Is The Property Tax Rate In Moncton Nb these pages focus on nb property taxes. A home valued at $330,000 would. Province scored record $777 million surplus last year. the tax rate is proposed to drop by 1.5 cents, from $1.4443 in 2023 to $1.4287 per $100 of assessed property value, for most of the city. in new brunswick, rates vary between by local service. What Is The Property Tax Rate In Moncton Nb.

From taxsaleshub.ca

Tax Sale in Albert Westmorland, New Brunswick 188 waverley avenue moncton Tax Sales Hub What Is The Property Tax Rate In Moncton Nb these pages focus on nb property taxes. the budget would cut the residential rate by 10.3 cents to $1.4443 per $100 of assessed value. For more information about nb property assessment, please visit: in new brunswick, rates vary between by local service districts (lsds) and municipalities as well as by property type. provincial property tax rates. What Is The Property Tax Rate In Moncton Nb.

From materialfulldioptric.z13.web.core.windows.net

Information On Property Taxes What Is The Property Tax Rate In Moncton Nb provincial property tax rates for the various categories of property are legislated under the real property tax act. For more information about nb property assessment, please visit: these pages focus on nb property taxes. Province scored record $777 million surplus last year. in addition, moncton lowered its tax rate by 6.2 per cent last year. in. What Is The Property Tax Rate In Moncton Nb.

From livingcost.org

Moncton Cost of Living, Salaries, Prices for Rent & food What Is The Property Tax Rate In Moncton Nb in addition, moncton lowered its tax rate by 6.2 per cent last year. A home valued at $330,000 would. provincial property tax rates for the various categories of property are legislated under the real property tax act. these pages focus on nb property taxes. For more information about nb property assessment, please visit: the budget would. What Is The Property Tax Rate In Moncton Nb.

From www.youtube.com

Understanding Your Property Taxes and Values YouTube What Is The Property Tax Rate In Moncton Nb the tax rate is proposed to drop by 1.5 cents, from $1.4443 in 2023 to $1.4287 per $100 of assessed property value, for most of the city. A home valued at $330,000 would. Province scored record $777 million surplus last year. the budget would cut the residential rate by 10.3 cents to $1.4443 per $100 of assessed value.. What Is The Property Tax Rate In Moncton Nb.

From taxsaleshub.ca

Tax Sale in Albert Westmorland, New Brunswick 80 leslie street, moncton Tax Sales Hub What Is The Property Tax Rate In Moncton Nb in new brunswick, rates vary between by local service districts (lsds) and municipalities as well as by property type. the tax rate is proposed to drop by 1.5 cents, from $1.4443 in 2023 to $1.4287 per $100 of assessed property value, for most of the city. in addition, moncton lowered its tax rate by 6.2 per cent. What Is The Property Tax Rate In Moncton Nb.

From eyeonhousing.org

How Property Tax Rates Vary Across and Within Counties Eye On Housing What Is The Property Tax Rate In Moncton Nb provincial property tax rates for the various categories of property are legislated under the real property tax act. these pages focus on nb property taxes. Province scored record $777 million surplus last year. the budget would cut the residential rate by 10.3 cents to $1.4443 per $100 of assessed value. in addition, moncton lowered its tax. What Is The Property Tax Rate In Moncton Nb.